Getting My Clark Wealth Partners To Work

Table of ContentsExcitement About Clark Wealth PartnersA Biased View of Clark Wealth PartnersThe 6-Second Trick For Clark Wealth PartnersAll about Clark Wealth PartnersTop Guidelines Of Clark Wealth PartnersGet This Report on Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Need To KnowClark Wealth Partners for Beginners

Common factors to take into consideration a financial advisor are: If your economic circumstance has actually become extra complex, or you do not have self-confidence in your money-managing skills. Conserving or browsing significant life occasions like marriage, divorce, children, inheritance, or work adjustment that may considerably affect your financial scenario. Navigating the change from conserving for retirement to maintaining wealth during retired life and how to produce a strong retirement earnings strategy.New technology has brought about more detailed automated financial tools, like robo-advisors. It's up to you to explore and determine the ideal fit - https://issuu.com/clrkwlthprtnr. Inevitably, a good monetary advisor ought to be as conscious of your financial investments as they are with their own, preventing too much costs, conserving money on tax obligations, and being as clear as feasible about your gains and losses

The Buzz on Clark Wealth Partners

Making a compensation on product suggestions doesn't always indicate your fee-based consultant works against your benefits. They may be more likely to suggest products and solutions on which they make a compensation, which may or might not be in your ideal passion. A fiduciary is legitimately bound to place their customer's interests.

This conventional enables them to make referrals for financial investments and solutions as long as they match their client's goals, risk tolerance, and financial situation. On the other hand, fiduciary experts are legally bound to act in their client's ideal passion rather than their very own.

Fascination About Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving into complicated financial subjects, clarifying lesser-known investment methods, and uncovering methods viewers can function the system to their advantage. As an individual financing specialist in her 20s, Tessa is really mindful of the effects time and unpredictability have on your financial investment decisions.

It was a targeted advertisement, and it functioned. Find look what i found out more Read much less.

What Does Clark Wealth Partners Mean?

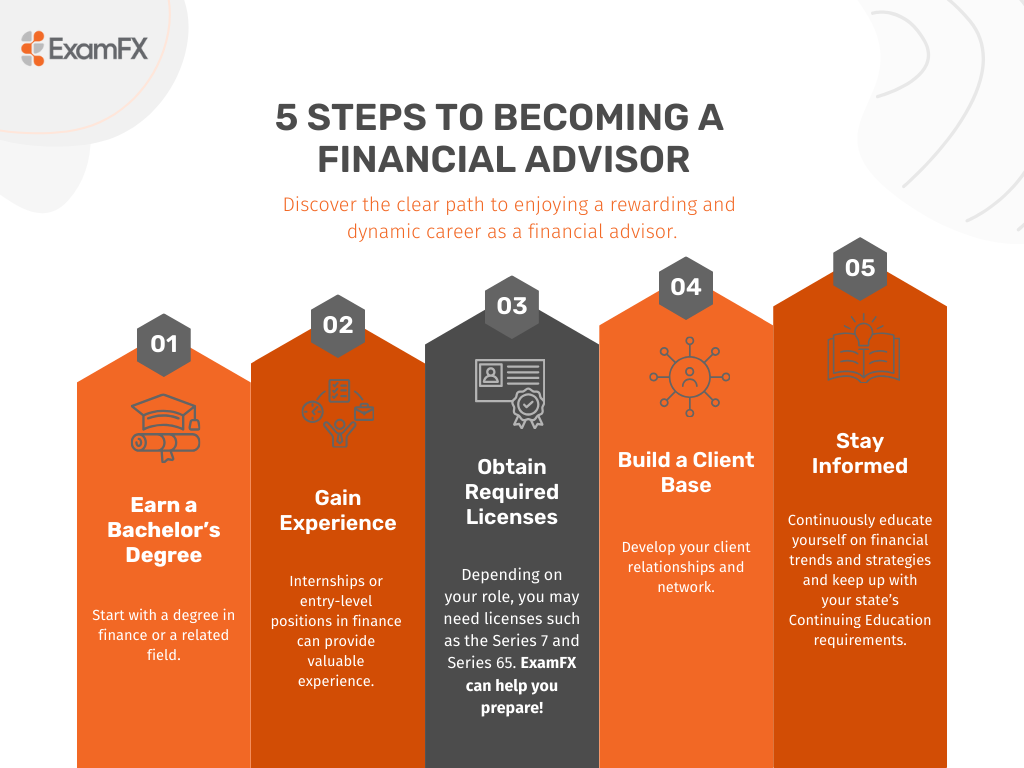

There's no solitary course to coming to be one, with some individuals starting in financial or insurance policy, while others begin in audit. 1Most economic planners start with a bachelor's degree in financing, economics, audit, organization, or a related topic. A four-year level provides a strong structure for jobs in investments, budgeting, and client services.

Clark Wealth Partners Can Be Fun For Anyone

Usual instances include the FINRA Series 7 and Collection 65 examinations for securities, or a state-issued insurance policy permit for offering life or health insurance coverage. While credentials might not be legally required for all preparing duties, employers and clients often watch them as a benchmark of expertise. We take a look at optional credentials in the following area.

The majority of financial planners have 1-3 years of experience and experience with monetary products, conformity criteria, and straight customer interaction. A strong academic history is important, yet experience shows the ability to apply theory in real-world settings. Some programs integrate both, allowing you to complete coursework while earning supervised hours with teaching fellowships and practicums.

Fascination About Clark Wealth Partners

Numerous get in the area after functioning in banking, bookkeeping, or insurance coverage, and the transition calls for perseverance, networking, and commonly sophisticated credentials. Very early years can bring long hours, stress to construct a client base, and the need to continuously show your expertise. Still, the job uses strong long-lasting potential. Financial organizers delight in the chance to function closely with customers, overview vital life decisions, and frequently attain versatility in schedules or self-employment.

Wealth managers can enhance their incomes via commissions, asset fees, and performance rewards. Economic supervisors look after a group of economic organizers and advisers, establishing department strategy, handling compliance, budgeting, and guiding interior operations. They invested much less time on the client-facing side of the market. Almost all monetary managers hold a bachelor's degree, and numerous have an MBA or similar graduate degree.

The 5-Second Trick For Clark Wealth Partners

Optional accreditations, such as the CFP, typically call for added coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Data, personal economic advisors gain a mean yearly annual wage of $102,140, with top income earners making over $239,000.

In various other provinces, there are laws that require them to fulfill specific demands to utilize the monetary consultant or financial coordinator titles (financial planner scott afb il). What sets some monetary experts aside from others are education and learning, training, experience and credentials. There are numerous classifications for economic advisors. For financial coordinators, there are 3 usual classifications: Qualified, Individual and Registered Financial Coordinator.

4 Easy Facts About Clark Wealth Partners Shown

Where to find a financial expert will depend on the type of suggestions you require. These institutions have team that may aid you comprehend and acquire certain types of financial investments.